10 Biblical Principles For Money Management

You want to honor God with your finances, but you also want practical steps you can take today. This article is for you—someone who wants your money to serve your life, not run it. You’ll get down-to-earth counsel grounded in Scripture, paired with pragmatic habits you can practice right away. I’ll walk with you through ten clear, actionable principles drawn from the Bible so you can build a financial life that reflects your values, protects your family, and advances God’s kingdom. Each principle includes a short explanation, a practical application, and a scriptural reference so you can go to the text yourself and let it shape your heart and habits.

Money isn’t evil. The misuse of money is. The Bible gives wise, trustworthy instruction about how to think about income, spending, saving, giving, and planning. When you follow these principles, you’re not just protecting your bank account—you’re stewarding God’s gifts to you. This article is written as a pastoral conversation—gentle, honest, and practical—so you can take a next step without feeling shamed or overwhelmed. Read each principle slowly, pray over it, and pick at least one small habit to start implementing this week. Together we’ll explore what healthy, biblical living looks like in your wallet, your checkbook, and your heart.

1. Recognize God Owns Everything: Stewardship, Not Ownership

When you accept that God owns everything, you shift from entitlement to stewardship. You’re not just a consumer or a spender—you’re a manager of resources entrusted to you. That changes how you prioritize, how you plan, and how you give. Stewardship frees you from the pressure to “keep up” with every cultural demand for more, because your identity and security are in God, not in possessions. Practically, this means you create a budget that reflects your values, set financial goals that honor God, and review your spending through the lens of purpose. You begin to ask, “How can this money serve God’s mission?” instead of “How can this money serve my appetite?” This perspective makes your money a tool for spiritual growth and kingdom impact, not merely personal satisfaction. Scripture reminds you plainly of the truth of God’s ownership: Psalm 24:1.

2. Work Diligently: Earn With Intention

God calls you to work hard and to work well. Your vocation is a platform for worship when you do your tasks with excellence and integrity. When you approach your job with a heart to serve, you increase your ability to provide for your family, to give generously, and to invest wisely. Laboring diligently protects you from laziness and idleness, which can lead to poor financial outcomes and unnecessary debt. Set goals at work, pursue skill development, and treat your career as a stewardship assignment. Remember that your earnings are not merely for consumption—they’re the means by which you bless others and advance God’s purposes. When you commit to excellence, you honor God and open doors for greater financial responsibility and influence. The apostle Paul gives this clear encouragement: Colossians 3:23.

3. Avoid Unnecessary Debt: Live Within Your Means

Debt can be a silent thief of freedom. When you borrow to live a lifestyle beyond your means, you trade future flexibility for present gratification. That’s why a core biblical principle of money management is to avoid crushing, unnecessary debt. This doesn’t mean you’ll never use credit—for example, prudent mortgage debt for a modest home can be appropriate—but it does mean you should be cautious about financing consumption. You develop a plan to pay down high-interest debt first, use cash where possible, and only borrow when it’s the most responsible option for your situation. Living within your means requires a realistic budget, a disciplined savings plan, and the humility to delay gratification when necessary. The Bible warns about the dangers of being enslaved by creditors: Proverbs 22:7.

4. Save and Plan: Prepare for the Future

Part of faithful stewardship is planning ahead. Saving is not a lack of faith—it’s a recognition that God often uses practical preparation to preserve and provide. You build an emergency fund to cover unexpected expenses, you set aside for retirement, and you plan for your family’s future. A simple habit like saving a percentage of your income each month compounds into security over time. Planning also helps you avoid panic-driven decisions that often lead to poor financial choices. When you build saving disciplines, you honor the wisdom the Bible gives about foresight and prudence, and you protect your family from shocks. In your planning, include both short-term and long-term objectives so money serves your calling rather than distracting you from it. Proverbs teaches the wisdom of preparation: Proverbs 21:20.

5. Give Generously: The Heart of Kingdom Finances

Generosity is central to Christian financial life. When you give, you acknowledge that what you have is not ultimately yours. Generosity isn’t only about the percentage you give; it’s about the posture of your heart. You give cheerfully, sacrificially, and consistently, trusting that God multiplies what is offered for His kingdom. Philanthropy and tithing cultivate dependence on God and push back against the selfish tendencies of our culture. Practically, decide in advance a giving plan—automate it, and make it non-negotiable in your budget. Giving also refocuses your life from accumulation to contribution, helping you invest in what truly matters. The New Testament celebrates the spiritual fruit of generous giving: 2 Corinthians 9:7.

6. Fight the Love of Money: Guard Your Heart

One of the clearest warnings in Scripture is about the love of money. It’s not money itself that corrupts—it’s the inordinate desire for it. When your heart clings to wealth as your security, identity, or happiness, you open the door to greed, anxiety, and moral compromise. Guarding your heart means cultivating contentment, prioritizing relationships over accumulation, and placing eternal values above temporary comforts. Practically, you can rehearse gratitude daily, limit exposure to materialistic media, and measure success by spiritual metrics rather than net worth. Train your heart to say “enough” and to find joy in God’s provision rather than in the next purchase. The Bible is blunt about the destructiveness of loving money: 1 Timothy 6:10.

7. Practice Contentment: Your Peace Is Not For Sale

Contentment is a spiritual discipline that protects your finances. When you’re content, you don’t chase the next upgrade, fashion, or gadget to feel whole. Contentment produces freedom to give, to save, and to invest in what lasts. It doesn’t mean you refuse to improve your situation; it means you refuse to let your circumstances determine your joy. Build a practice of gratitude, keep a simple lifestyle that matches your values, and evaluate purchases by asking whether they serve your long-term calling. Contentment helps you avoid impulse spending and the stress that uncontrolled desires create. It’s a humble confession that God is sufficient for you in every season. Scripture calls you to keep your life free from the tyranny of materialism: Hebrews 13:5.

8. Be Honest and Transparent: Integrity in All Transactions

Your financial life should reflect your character. Honesty in business, taxes, and personal dealings protects your witness and preserves trust. When you’re transparent about your finances—within appropriate boundaries—you invite accountability that strengthens stewardship. Avoid shady shortcuts, misrepresentations, or manipulative tactics to get ahead. Instead, build systems that produce accurate records, regular reviews, and clear communication with your spouse or family members. If you run a business, treat employees fairly and pay them what they’re owed. Living with integrity may sometimes cost you, but it protects you from long-term ruin and aligns you with God’s ways. The Bible condemns dishonest practices and elevates righteousness in commerce: Proverbs 11:1.

9. Seek Wise Counsel: You Don’t Have to Do This Alone

Financial decisions are rarely made in a vacuum. You need wise, mature voices around you—whether that’s your spouse, a trusted friend, a financial advisor, or spiritual mentors. Surrounding yourself with counsel helps you avoid blind spots and impulsive choices. When you’re making big decisions—buying a house, investing, starting a business, or changing careers—consult someone who has walked that path and demonstrates trustworthiness. Counsel doesn’t eliminate responsibility; it amplifies your wisdom. You should also be part of a community where accountability and encouragement are natural. Proverbs captures the power of counsel: plans succeed when many advisers speak into them. Don’t shoulder heavy choices alone—seek guidance and test your motives with people who love you and know Scripture: Proverbs 15:22.

10. Keep an Eternal Perspective: Invest in What Lasts

Ultimately, money is a means to an end. You want your finances to reflect eternal priorities—things that matter in God’s economy, not merely in this life. That means investing in people, missions, discipleship, and acts of mercy that last beyond your lifetime. When you adopt an eternal perspective, you’re willing to sacrifice short-term pleasure for long-term kingdom fruit. Evaluate every financial decision by asking, “Will this help advance the gospel, bless others, or grow godly character?” This lens helps you resist consumerism and motivates you to steward resources for heaven’s purposes. Jesus invites you to store treasures where moth and rust don’t destroy: treasures of love, obedience, and spiritual fruit. Keep your heart aligned with that higher calling: Matthew 6:19-21.

Conclusion: Start Small, Stay Faithful

You don’t have to overhaul everything overnight. Pick one principle from these ten to focus on for the next 30 days—maybe it’s creating a simple budget, starting a small emergency fund, or automating one percent of your income to giving. Small, consistent steps build habits that outlast temporary motivation. Remember: biblical money management is less about strict rules and more about a Christ-centered heart that uses resources to glorify God and love people. Keep learning, stay accountable, and give yourself grace when you stumble. God honors faithful effort, and He’ll meet you in the process as you pursue wisdom.

Explore More

For further reading and encouragement, check out these posts:

👉 7 Bible Verses About Faith in Hard Times

👉 Job’s Faith: What We Can Learn From His Trials

👉 How To Trust God When Everything Falls Apart

👉 Why God Allows Suffering – A Biblical Perspective

👉 Faith Over Fear: How To Stand Strong In Uncertain Seasons

👉 How To Encourage Someone Struggling With Their Faith

👉 5 Prayers for Strength When You’re Feeling Weak

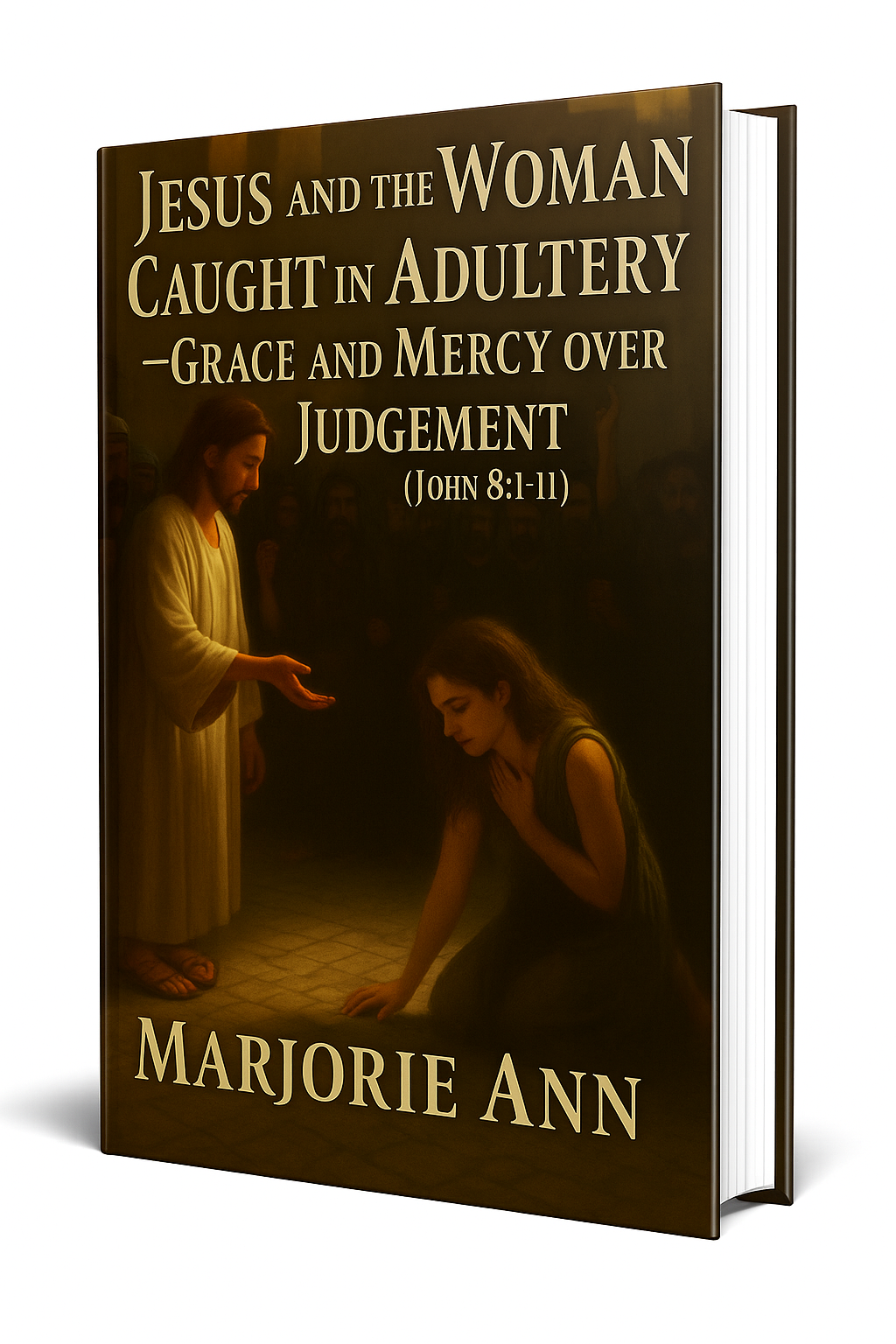

📘 Jesus and the Woman Caught in Adultery – Grace and Mercy Over Judgement

A powerful retelling of John 8:1-11. This book brings to life the depth of forgiveness, mercy, and God’s unwavering love.

👉 Check it now on Amazon

As a ClickBank Affiliate, I earn from qualifying purchases.

Acknowledgment: All Bible verses referenced in this article were accessed via Bible Gateway (or Bible Hub).

“Want to explore more? Check out our latest post on Why Jesus? and discover the life-changing truth of the Gospel!”